Beyond Rigid Rules: Adapting Financial Strategies for Modern Times

Bending the Rules of Financial Success

Did you know that 65% of Americans believe they’ll never accumulate $1 million in savings? This statistic isn’t just shocking—it’s a wake-up call. What if I told you that the very financial advice you’ve been following might be the obstacle standing between you and true wealth? Welcome to the world of financial flexibility, where we’re not just thinking outside the box—we’re reimagining the box altogether.

In a world where economic landscapes shift like sand dunes, clinging to rigid financial rules is like trying to build a castle on the beach at high tide. It’s time to embrace a new paradigm: The Flexibility Mindset. This isn’t just about managing money; it’s about revolutionizing your relationship with wealth. Are you ready to unlearn everything you thought you knew about finance?

The Financial Advice Trap: Why Traditional Wisdom Falls Short

Traditional financial advice often reads like a one-size-fits-all instruction manual: save 20% of your income, avoid debt at all costs, invest conservatively as you age. While these principles aren’t inherently wrong, they’re often woefully inadequate for navigating the complexities of modern economic realities.

The challenges are numerous:

- Stagnant wages coupled with rising living costs

- The gig economy’s unpredictable income streams

- Unprecedented global economic shifts

- Rapidly evolving investment landscapes (think cryptocurrencies and NFTs)

Many find themselves paralyzed by conflicting advice or stuck in financial strategies that worked for previous generations but fail to launch in today’s world. The result? A pervasive feeling of financial anxiety and a growing wealth gap.

But what if the problem isn’t the economy or your income—what if it’s the lens through which you view financial success?

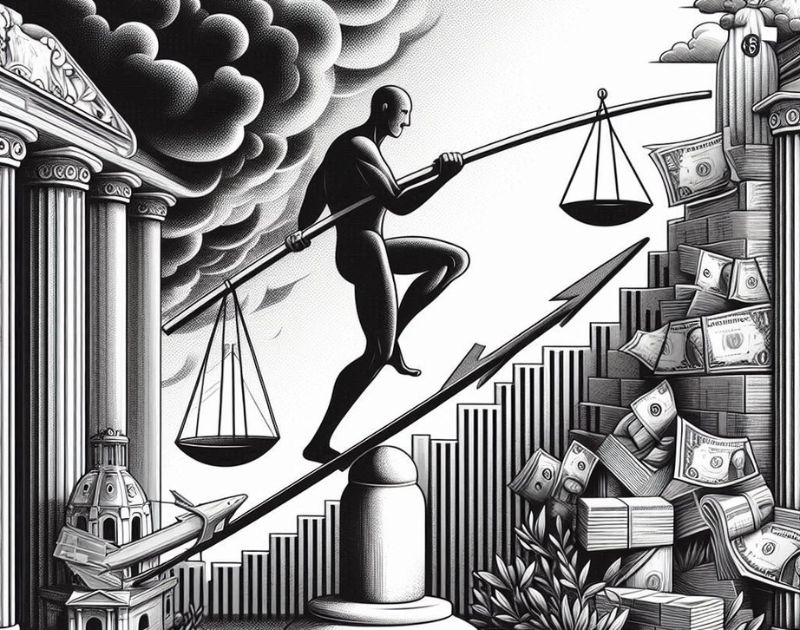

The Paradigm Shift: From Financial Rigidity to Fiscal Fluidity

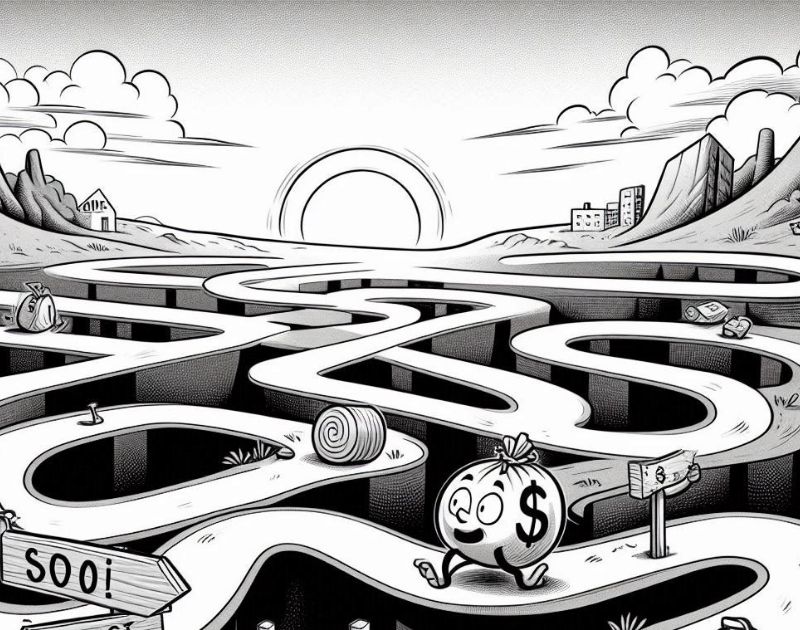

Enter the concept of “Fiscal Fluidity”—a revolutionary approach that treats your financial strategy not as a set of unbreakable rules, but as a dynamic, adaptable system. Think of your finances not as a rigid structure, but as a living ecosystem that evolves with you and the world around you.

Imagine your financial life as a river, not a road. A road is fixed, with clear directions and defined boundaries. A river, however, adapts to its environment—carving new paths when faced with obstacles, speeding up or slowing down as needed, and even changing direction when necessary.

This Fiscal Fluidity challenges conventional wisdom in several key ways:

- It values adaptability over strict adherence to rules

- It embraces calculated risks rather than avoiding them entirely

- It focuses on value creation rather than mere preservation

- It treats financial setbacks as learning opportunities, not failures

By adopting this mindset, you’re not just managing your money—you’re cultivating a dynamic financial ecosystem that can thrive in any economic climate.

Deep Dive: Key Insights into Fiscal Fluidity

1. The 70/30 Flux Ratio

Explanation: Instead of rigid budget categories, allocate 70% of your income to a fixed “foundation” and 30% to a “flux fund” that can be redirected based on current opportunities or challenges.

Example: Sarah, a freelance designer, used her flux fund to invest in a high-return short-term project during a slow month, effectively doubling her typical monthly income.

Actionable Tip: Review your last three months of expenses. Identify areas where flexibility could have created opportunities, then restructure your budget to include a flux fund.

2. Debt as a Tool, Not a Trap

Explanation: Reframe debt not as a universal evil, but as a potential lever for growth when used strategically.

Example: Tom used a low-interest loan to invest in real estate during a market dip, generating rental income that exceeded his loan payments and building long-term equity.

Actionable Tip: Evaluate your current debts. For each, ask: “Is this debt holding me back or propelling me forward?” Create a plan to eliminate restrictive debt and leverage productive debt.

3. The Skill Stack Investment Strategy

Explanation: Invest not just in traditional assets, but in developing a diverse skill set that can generate multiple income streams.

Example: Maria, an accountant, invested time in learning data analytics. This new skill allowed her to command higher rates and opened up consulting opportunities, significantly increasing her income potential.

Actionable Tip: Identify three skills that could complement your current income sources. Allocate time and resources to developing one of these skills in the next three months.

4. Financial Decision Trees

Explanation: Replace rigid financial rules with flexible decision trees that adapt to your changing circumstances.

Example: Instead of always prioritizing debt repayment, Alex created a decision tree that helped him balance debt repayment with investment opportunities, leading to a 20% increase in his net worth over two years.

Actionable Tip: Create a basic decision tree for your next major financial decision, considering multiple scenarios and potential outcomes.

5. The Micro-Experiment Approach

Explanation: Test new financial strategies with small, low-risk experiments before fully committing.

Example: Before quitting her job to start a business, Lisa used her flux fund to launch a small side project, allowing her to test the market and refine her business model with minimal risk.

Actionable Tip: Identify a new financial strategy you’ve been considering. Design a micro-experiment to test it using no more than 5% of your monthly income.

The Roadmap to Fiscal Fluidity

- Mindset Reset (Week 1-2)

- Identify and challenge your deeply held financial beliefs

- Journal about your emotional responses to money

- Financial Ecosystem Mapping (Week 3-4)

- Create a visual map of your current income streams, expenses, and financial goals

- Identify areas of rigidity and potential flexibility

- Flux Fund Establishment (Week 5-6)

- Restructure your budget to include a flux fund

- Set clear criteria for using the flux fund

- Skill Stack Development (Week 7-10)

- Choose one new skill to develop

- Allocate time and resources to learning

- Micro-Experiment Design (Week 11-12)

- Design and implement your first financial micro-experiment

- Document outcomes and learnings

- Strategy Refinement (Ongoing)

- Monthly review and adjustment of your fiscal fluidity strategies

- Quarterly “big picture” reassessment

Potential Obstacles and Solutions:

- Fear of Uncertainty: Use the micro-experiment approach to build confidence gradually.

- Information Overload: Focus on one new strategy at a time, mastering it before moving on.

- Lack of Support: Join or create a “Fiscal Fluidity” support group to share experiences and advice.

The Ripple Effect: Beyond Personal Finance

Embracing Fiscal Fluidity doesn’t just transform your bank account—it revolutionizes your entire approach to life and work. As you develop a more adaptable relationship with money, you’ll likely find this flexibility spilling over into other areas:

- Career Decisions: You’ll be more open to taking calculated risks that can lead to significant growth.

- Personal Relationships: Financial stress often strains relationships. A more flexible approach can lead to more open, collaborative financial discussions with partners and family.

- Life Goals: With a more adaptable financial strategy, you may find yourself reimagining what’s possible in terms of travel, education, or personal projects.

- Stress Management: By viewing financial challenges as opportunities for adaptation rather than insurmountable obstacles, overall stress levels often decrease.

Imagine a life where financial decisions are met not with anxiety, but with a sense of curious exploration. This is the true power of the Flexibility Mindset.

Expert Insights: Unexpected Perspectives

Dr. Elena Rodriguez, Evolutionary Biologist: “In nature, the most successful species are not the strongest or the smartest, but the most adaptable. The same principle applies to financial strategies in our rapidly changing economic environment.”

Chef Gordon Ramsay: “In the kitchen, the best chefs aren’t those who rigidly follow recipes, but those who understand ingredients so well that they can improvise and create. Your finances should be approached with the same creative flexibility.”

These insights remind us that the principles of flexibility and adaptation are universal, applying as much to our financial lives as they do to the natural world or the culinary arts.

Addressing the Skeptics: Embracing Calculated Risks

You might be thinking, “This all sounds great, but isn’t it risky? What about financial security?” It’s a valid concern. After all, we’ve been conditioned to believe that financial safety lies in strict rules and conservative strategies.

However, in an era of unprecedented economic change, the greatest risk often lies in inflexibility. A study by the Financial Planning Association found that individuals with more adaptable financial strategies were 37% more likely to report feeling financially secure than those who adhered strictly to traditional advice.

Moreover, the Fiscal Fluidity approach doesn’t advocate for recklessness—it promotes calculated, informed risk-taking. By starting with micro-experiments and gradually expanding your comfort zone, you’re actually building a more robust financial foundation than one built on rigid rules that may become obsolete.

Remember, the goal isn’t to throw caution to the wind, but to develop a nuanced, responsive approach to your finances that can weather any economic storm.

Interactive Element: The Fiscal Fluidity Quotient (FFQ) Assessment

To help you gauge your current financial flexibility and identify areas for growth, we’ve developed the Fiscal Fluidity Quotient (FFQ) Assessment. This interactive tool:

- Evaluates your current financial strategies across multiple dimensions

- Assesses your comfort level with financial adaptation and risk

- Identifies your strengths and areas for improvement in fiscal fluidity

- Provides personalized recommendations for developing a more flexible financial mindset

The FFQ isn’t just a score—it’s a roadmap for your journey towards greater financial adaptability and success.

Fiscal Fluidity Quotient (FFQ) Assessment

Your Next Steps: From Insight to Action

Now that you’ve been introduced to the concept of Fiscal Fluidity, it’s time to take action. Here’s your challenge:

- Complete the Fiscal Fluidity Quotient Assessment within the next 48 hours.

- Identify one traditional financial “rule” you’re willing to challenge in your own life.

- Design a micro-experiment to test a more flexible approach to this rule over the next 30 days.

- Share your experience in our “in the comments” to get feedback and support.

Remember, developing Fiscal Fluidity is a journey, not a destination. Commit to reviewing and refining your approach monthly. Each small step towards flexibility is a giant leap towards financial empowerment.

The Future of Finance: Your Personal Economic Evolution

As we look to the future, the only certainty is change. By embracing the Flexibility Mindset and developing your Fiscal Fluidity, you’re not just preparing for this future—you’re actively shaping it.

Imagine a world where financial stress is replaced by financial creativity. Where economic challenges are met not with fear, but with innovative solutions. Where your money works with you, not against you, adapting and growing as you do.

This isn’t just a dream—it’s the reality you can create through the power of financial flexibility. The question isn’t whether you can afford to adopt this mindset, but whether you can afford not to.

So, are you ready to unlearn, relearn, and revolutionize your financial future?

Did You Know?

- People who regularly revisit and adjust their financial strategies are 45% more likely to achieve their long-term financial goals.

- The average millionaire has seven streams of income, highlighting the importance of financial diversity and flexibility.

- Economic predictions have been wrong 77% of the time, underscoring the need for adaptable financial strategies.

Questions to Ponder:

- What financial “rule” have you been following that might be limiting your growth potential?

- If you were to design your ideal financial life with no limitations, what would it look like?

- How might your life change if you viewed financial setbacks as opportunities rather than failures?

Further Reading:

- “Antifragile” by Nassim Nicholas Taleb – Explores the concept of gaining from disorder

- “The Psychology of Money” by Morgan Housel – Offers insights into our emotional relationship with finance

- “Range” by David Epstein – Makes a case for the power of versatility in an unpredictable world

- “Thinking in Bets” by Annie Duke – Provides a framework for making decisions under uncertainty

- “The Almanack of Naval Ravikant” – Offers unconventional wisdom on wealth and happiness