How to Save Money Fast on a Low Income

If you’re on a low income, it can be hard to save money. But with a few simple strategies, you can start saving money fast. In this blog post, we’ll share some tips on how to save money on a low income. By following these tips, you’ll be able to start building up your savings and reach your financial goals. So let’s get started!

Get a part-time job to supplement your income

Taking on a part-time job can help you bring in extra money that you can use to save. You don’t have to commit to anything long-term, just look for jobs that fit your skills and availability.

Cut back on unnecessary expenses, like eating out or buying new clothes

If you’re trying to save money on a low income, it’s important to make sure that you’re only spending money on things that are necessary. That means cutting back on things like eating out or buying new clothes when you don’t need them.

Find ways to save money on essential expenses, like groceries and utilities

If you’re on a budget, you can still save money on the essentials. Look for ways to get discounts or find cheaper alternatives for things like groceries and utilities. For example, shop around for the best deals when it comes to grocery shopping, and look for options that offer lower rates for your utility bills.

Create a budget and stick to it

Creating a budget and sticking to it is one of the best ways to save money on a low income. It’ll help you keep track of your spending and make sure that you’re only spending what you can afford. Plus, by sticking to a budget, you’ll be able to prioritize saving so that you can reach your financial goals faster.

Automate your savings

Automating your savings can make it easier for you to save money on a low income. You can set up automatic transfers from your checking account to your savings account so that you’re putting away money without even thinking about it. That way, you’ll never miss an opportunity to save and build up your savings.

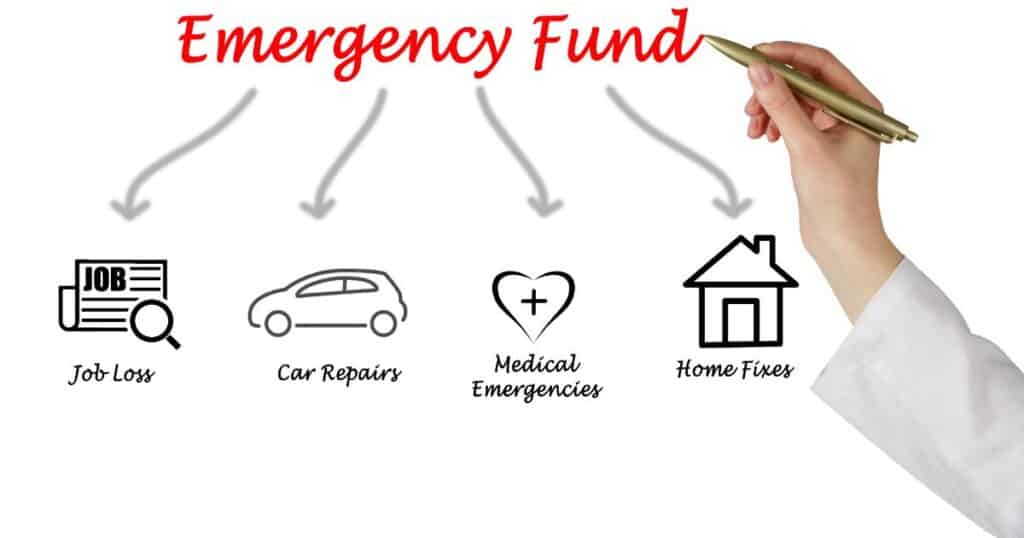

Have an emergency fund in case of unexpected costs

Unexpected expenses can happen when you least expect it, so it’s important to have an emergency fund in case of any surprises. Having a dedicated savings account for emergencies will help ensure that you’re financially prepared if something unexpected happens.

Invest in yourself by taking courses or learning new skills that can help you get ahead financially

Investing in yourself is one of the best ways to save money on a low income. Look for courses or programs that can help you learn new skills and gain knowledge that can help you get ahead financially. That way, you’ll be able to take advantage of opportunities and start earning more money over time.

Use Rakuten When Shopping Online

Finally, don’t forget to use Rakuten when you’re shopping online or in some physical stores. It’s free to join and you can get cashback on almost any purchase you make. That way, you’ll be able to save money on things like clothes, electronics and more.

Create a Money Saving Challenge

Creating a money saving challenge can be a fun and rewarding way to save money on a low income. Set yourself a goal, such as saving $50 in one month, and set up accountability measures so that you stay on track with your savings goals. You can also try making it into a game or competition with friends or family members to make it more enjoyable.

Save By Paying Yourself First

Lastly, don’t forget to pay yourself first. Whenever you receive money, make sure that you set aside a portion of it for savings. This will help ensure that you’re putting away money each month and building up your savings over time.

Consolidate Your Debt

If you’re having trouble paying off your debt, look into consolidating your debt. Consolidating your debts can help reduce the interest rate and simplify the repayment process, which can make it easier for you to save money on a low income.

Summary: How to save money fast on a low income

Finding ways to save money when you are living on a low income is possible with some strategic planning and budgeting. By automating your savings, creating a budget and sticking to it, investing in yourself, utilizing cashback programs like Rakuten, taking on money saving challenges, and paying yourself first, you can take control of your finances and start saving more without sacrificing your lifestyle.

Additionally, consolidating your debt can help reduce interest rates and simplify the repayment process, which can make it easier to save money on a low income. With these tips, you can make the most of your limited resources and start building a more secure financial future for yourself.

That’s A Wrap.

By following these steps, you’ll be able to create a financially secure future for yourself even when living on a tight budget. You’ll be able to save money, pay off debt, and reach your financial goals in no time.

So don’t wait – start taking control of your finances today! With a little bit of discipline and the right tools, you can make the most out of living on a low income and create a secure financial future for yourself. Good luck!

Good luck with your journey to saving money on a low income. With dedication and resourceful strategies, you can take control of your finances and build long-term financial security.