How to Become a Millionaire 5 Proven Ways

There is no specific way to become rich, as it often depends on individual circumstances and abilities. Some common ways to build wealth include investing in the stock market, starting a business, real estate investing, saving and budgeting, and earning a high-paying job or career.

It’s also important to note that becoming rich may not be the ultimate goal for everyone and that there are many other ways to measure success and happiness.

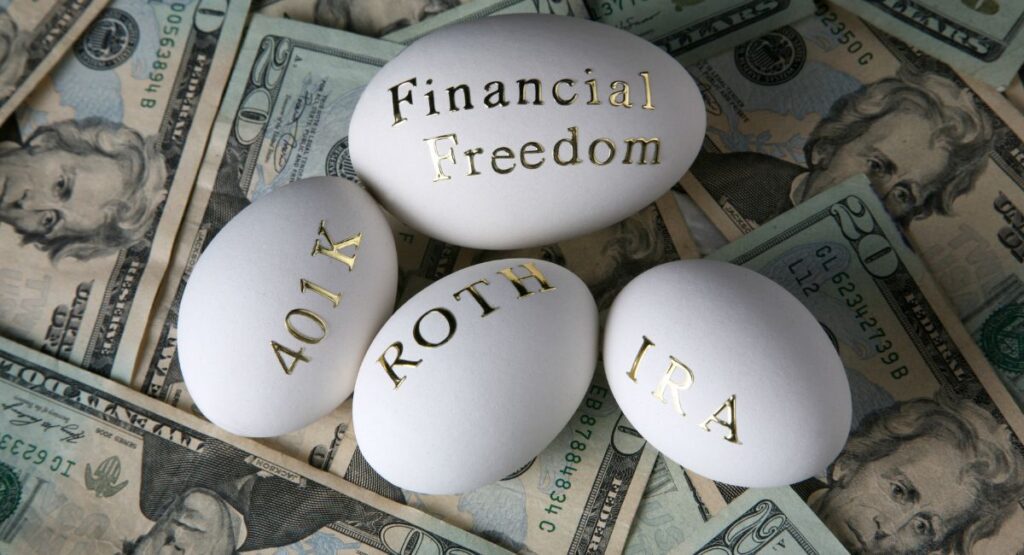

Investing in the Stock Market

Investing in the stock market: This can be a great way to grow your money over time, but it’s essential to do your research and invest wisely. Consider a diversified portfolio and consult a financial advisor if you need guidance.

Investing in the stock market can be a great way to grow your money over time, but it’s essential to understand that it’s not without risk. One of the critical things to remember when investing in the stock market is to diversify your portfolio.

Diversification means spreading your money across different assets, such as stocks, bonds, real estate, and other sectors, such as technology, healthcare, and energy. This can help reduce the risk of losing money if one particular stock or sector performs poorly.

When investing in the stock market, it’s also important to research and invests wisely. This means staying informed about the companies you’re investing in and their financial performance and paying attention to macroeconomic factors that can affect the stock market.

It’s also essential to have a long-term investment horizon, meaning to stay invested for a more extended period, as short-term volatility is standard in the stock market.

Another critical thing to remember is to have a financial advisor who can help you create a personalized investment strategy based on your goals, risk tolerance, and time horizon. They can also provide valuable insights and advice to help you make more informed investment decisions.

It’s also worth mentioning that before investing in the stock market, it’s essential to have an emergency fund. It’s a savings account for unexpected expenses such as car repairs, medical bills, or job loss. Having at least 6 months of living expenses saved in an emergency fund is essential before you start investing in the stock market.

Start A Business

Starting your own business can be a great way to build wealth and create a stream of passive income, but it’s essential to understand that it’s not without risk. Make sure you have a solid business plan and the necessary skills and resources to start and grow a business.

Starting a business requires a lot of hard work, dedication, and a willingness to take risks. Before starting a business, having a solid business plan is crucial.

This should include a clear description of your product or service, your target market, your competition, and your marketing and sales strategies. A business plan will help you to focus your efforts, set measurable goals, and make informed decisions about how to grow your business.

You must also ensure you have the necessary skills and resources to start and grow your business. This may include things like marketing, sales, and management skills, as well as the financial resources to cover your startup costs and keep your business running until it becomes profitable.

It’s also essential to have proper research on the market and the industry you’re planning to enter. This will help you to identify potential challenges, opportunities, and trends.

Consider seeking professional advice from an accountant, lawyer, or business consultant to help you navigate the legal and financial aspects of starting a business.

Starting a business also requires a lot of patience, persistence, and resilience. It can take time to build a customer base and generate revenue, and there may be setbacks along the way.

But with a solid business plan, the right skills and resources, and a willingness to persevere, starting a business can be a great way to build wealth and create a stream of passive income over time.

Real Estate Investing

Investing in real estate can be a great way to build wealth through rental income, appreciation, and tax benefits. You can invest in properties directly or in real estate investment trusts (REITs), allowing you to invest in a diversified portfolio of properties.

Real estate investing can be a great way to build wealth and create passive income. One of the most significant benefits of investing in real estate is the potential for rental income. You can earn a steady monthly income by purchasing and renting a property.

Additionally, real estate can appreciate in value over time, which means that your property may be worth more in the future than it is today. This can lead to significant capital gains when you eventually sell the property.

Another benefit of real estate investing is the potential for tax benefits. For example, you may deduct certain expenses, such as mortgage interest and property taxes, from your income taxes. Additionally, you can defer or avoid paying taxes on your capital gains if you invest in real estate through a 1031 exchange.

You can invest in real estate directly by purchasing a property and becoming a landlord. However, this can be a significant undertaking and requires time and effort. An alternative is to invest in real estate investment trusts (REITs).

REITs allow you to invest in a diversified portfolio of properties without the responsibilities of being a landlord. REITs are publicly traded and can be bought and sold just like stocks.

It’s also important to note that real estate investing comes with risk. The value of your property can decrease over time, and you may need help finding and retaining tenants.

Additionally, real estate markets can be cyclical, meaning they can go through periods of growth and decline. It’s essential to research, understand market conditions, and seek professional advice before investing in real estate.

Overall, real estate investing can be a great way to build wealth, but it’s essential to understand the potential risks and benefits and to approach it with a long-term perspective.

Saving & Budgeting

Building wealth often starts with the simple habit of saving and budgeting. Make sure you’re living below your means and regularly setting aside money for your future.

Saving and budgeting may seem like simple and mundane tasks, but they are the foundation of building wealth. A budget is a plan for how you will spend your money, and it’s essential for achieving your financial goals.

It can help you to understand where your money is going, identify areas where you can cut back, and ensure that you’re setting aside enough money for savings and investments.

Living below your means is vital when it comes to saving and budgeting. It means you’re spending less than you earn and not relying on credit to make ends meet. By living below your means, you’ll be able to save a more significant percentage of your income, giving you more money to invest and grow your wealth.

It’s also important to regularly set aside money for your future. This means creating a savings plan and sticking to it. It’s essential to have an emergency fund, a savings account set aside for unexpected expenses such as car repairs, medical bills, or job loss. Having at least 6 months of living expenses saved in an emergency fund before you start investing in the stock market is necessary.

You should also have a retirement savings plan and consider saving for other long-term goals, such as purchasing a home or paying for your children’s education. Setting aside a certain percentage of your income for these goals and keeping track of your progress will help you stay motivated and focused on your long-term financial plans.

In conclusion, saving and budgeting may not be the most glamorous ways of building wealth, but they are essential for achieving long-term financial success. By living below your means, budgeting your expenses, and regularly setting aside money for your future, you’ll be able to build a strong foundation for your wealth and work towards your financial goals.

High Paying Career

Pursuing a high-paying job or career can be a powerful way to build wealth over time. By earning more money, you’ll have more disposable income to save and invest, which can help you to achieve your financial goals more quickly.

Building a solid set of skills and qualifications is essential to increase your earning potential. Consider returning to school to get a degree or additional certifications that will make you more valuable to potential employers. Investing in your education and professional development can open up new opportunities and lead to higher-paying jobs.

Consider also looking for industries and fields that are in high demand. These industries tend to pay higher salaries and offer more opportunities for advancement. For example, careers in technology, healthcare, and finance tend to be well-paying, and they are projected to continue growing in the coming years.

Networking is also a key component to finding high-paying jobs and career opportunities. Building a solid network of professional contacts can help you to learn about new job openings and get your foot in the door with top employers.

It’s also important to note that earning a high salary is not the only way to build wealth. It’s also important to live below your means, save and invest wisely, and have a long-term perspective.

A high-paying job can provide a solid foundation for building wealth, but it’s essential to use your income wisely and make smart financial decisions to build wealth over time.

In summary, pursuing a high-paying job or career can significantly increase your earning potential and build wealth over time. Investing in your education and professional development, looking for industries and fields in high demand, networking, and making wise financial decisions can build a strong foundation for achieving your financial goals.

Conclusion

Becoming rich takes time and effort. It takes a lot of hard work, intelligent financial decisions, discipline, and patience. Building wealth requires a long-term perspective and a commitment to making wise financial decisions consistently.

It’s important to understand that there are no shortcuts to wealth. Building wealth requires a consistent effort over time. It requires the willingness to work hard, save and invest wisely, and make sacrifices in the short term for your long-term financial goals.

It’s also vital to have discipline and patience, as building wealth often requires delaying gratification and sticking to a plan even when it gets difficult. It’s necessary to stay focused on your long-term goals and not get swayed by get-rich-quick schemes or the temptation to spend money on things that aren’t truly important to you.

It’s also important to make intelligent financial decisions. This means staying informed about your investments and the markets, having a budget and sticking to it, and seeking professional advice when needed.

It’s also worth noting that becoming rich is not the only measure of success. There are many other ways to measure happiness and fulfillment. Building wealth is a means to an end, not an end. It’s essential to balance building wealth and enjoying the present.

In conclusion, becoming wealthy takes time and effort. It takes a lot of hard work, intelligent financial decisions, discipline, and patience. It requires a long-term perspective, a commitment to prudent financial decisions, and a balance between building wealth and enjoying the present.